Automatic Savings

At Nubank, we began prioritizing initiatives focused on financial control, which required forming a dedicated team to design and develop customer-centric solutions.

To kick off the project, we created a strategy to shape the product vision and foster a sense of unity among team members just starting to collaborate. This involved foundational dynamics to establish the team’s vision, mission, and values, alongside a strategy rooted in business goals, technological opportunities, and user pain points. We developed our first MVP and achieved results that informed the next steps of the product.

As the sole designer on this project, I led the design efforts while collaborating with my talented team and the exceptional research department whenever needed.

Problems & Goals

Define the team's vision, mission, and values to establish a strong foundation and shared purpose.

Develop a short- and medium-term strategy aligned with business objectives, technological opportunities, and user needs.

Create a prioritized feature backlog to ensure a clear roadmap for development.

Design and deliver an MVP, focusing on solving core user pain points.

Analyze results and outline next steps to guide future iterations and improvements.

Results

We developed features to help users save money automatically, which are now used by approximately 230,000 users with a 75% retention rate. These features have successfully automated savings of around R$70 million (data as of 06/25/2020).

Quantitative and qualitative analyses show that the feature is easy to use. However, exploring additional saving rules not prioritized in this release could help motivate a broader user base in future iterations.

Methodology

1. Financial Control Chattering

The first step in developing the new pack was creating team dynamics to define our identity and align our goals. The aim was to foster a sense of unity—both among team members and in the direction we wanted to pursue—to ensure optimized efforts and focus.

By the end of this phase, we had a clear document outlining who we were, what we aimed to achieve, and, most importantly, what was outside our scope. This clarity set the foundation for our work moving forward.

2. Understanding Financial Control Journey

Once we had a clear vision of our direction, the next step was to explore potential future paths. Together with the team, we conducted extensive research—both internally and externally—on consumer behavior, creating a comprehensive financial journey map. This map provided insights into users' financial habits and needs, helping us identify the best starting points for development.

As part of this effort, we categorized financial behaviors into three types and identified four macro-categories of products, which guided our strategic focus.

These were not strict behavioral models, as each category included diverse behaviors. Instead, they served as a foundation to identify initial opportunities and determine where it made sense to act, balancing business potential with engineering complexity.

We concluded that the best approach at this stage was to focus on initiatives that help people save more effectively and efficiently—an evolution of what our account product was already achieving.

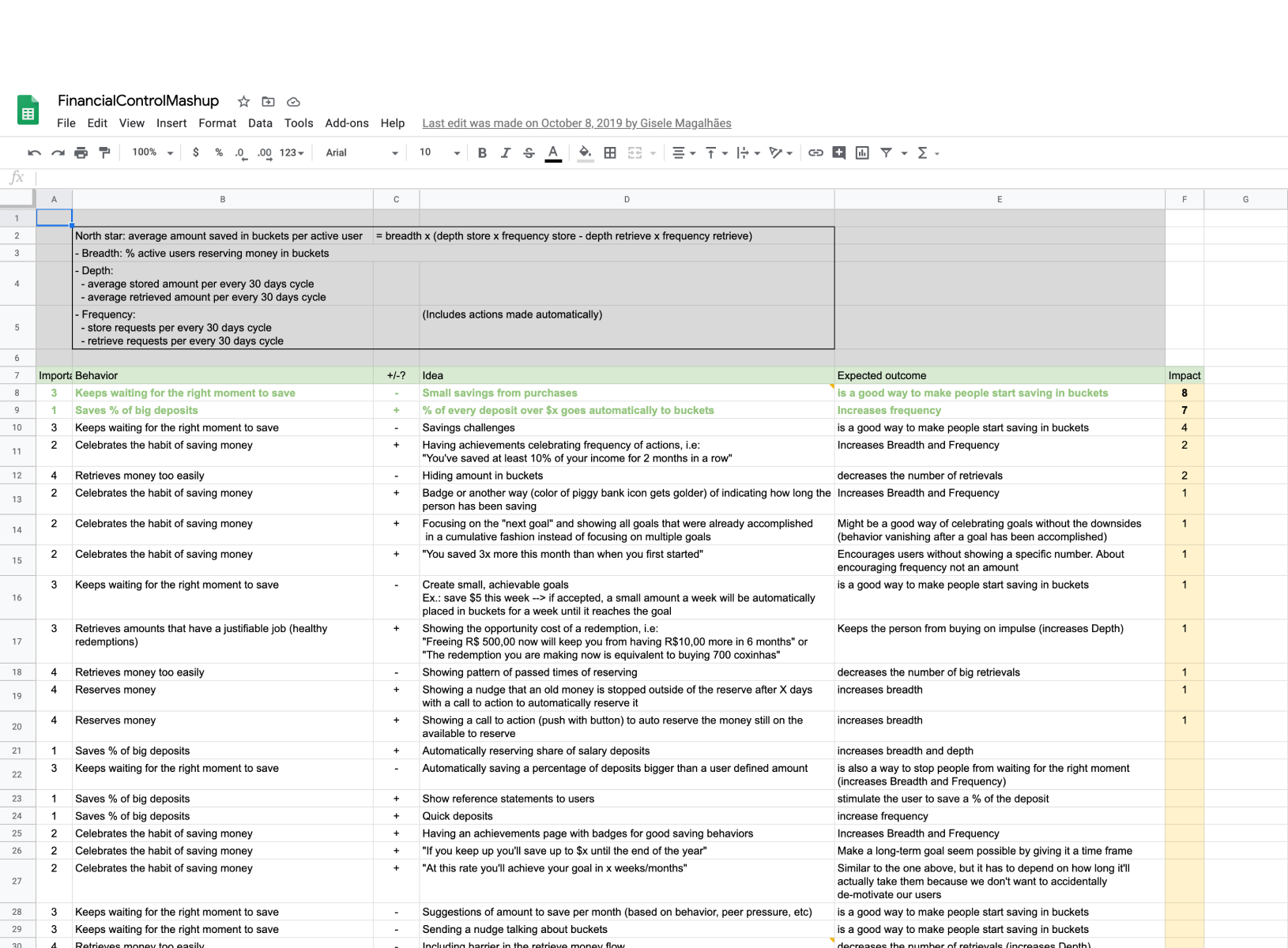

3. Ideation

With a clear understanding of business goals and user pain points, we organized a workshop with the entire team using the Crazy 8 method to brainstorm ideas for reducing friction in saving money.

After generating and compiling ideas, we collaborated with engineering and business stakeholders to evaluate which concepts offered the greatest impact—balancing development speed with business returns.

The conclusion was to focus on reducing friction for users to save continuously. By simplifying and, where possible, automating the saving process, we aimed to make it effortless and habitual, encouraging long-term engagement.

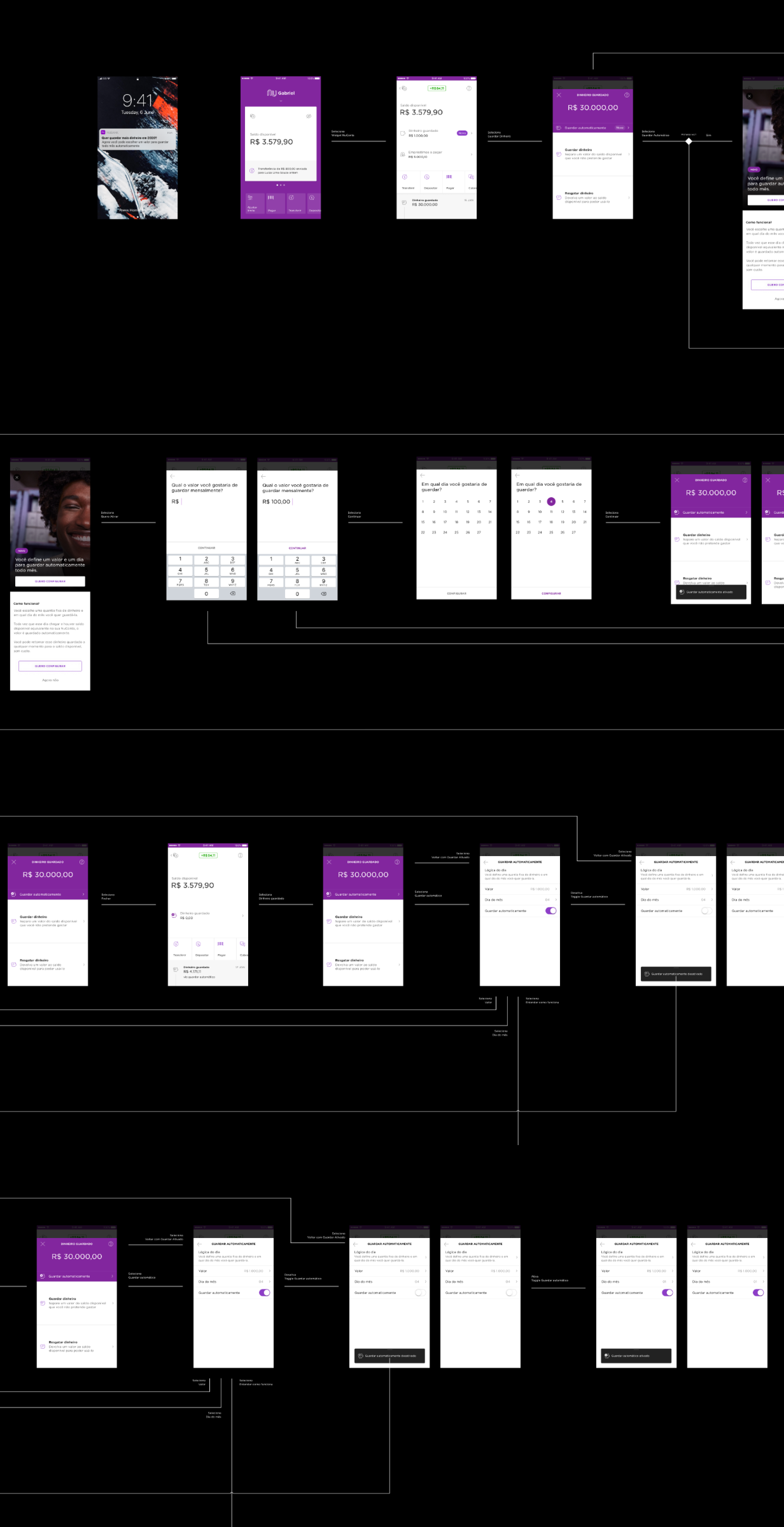

4. Automatic Savings Explorations

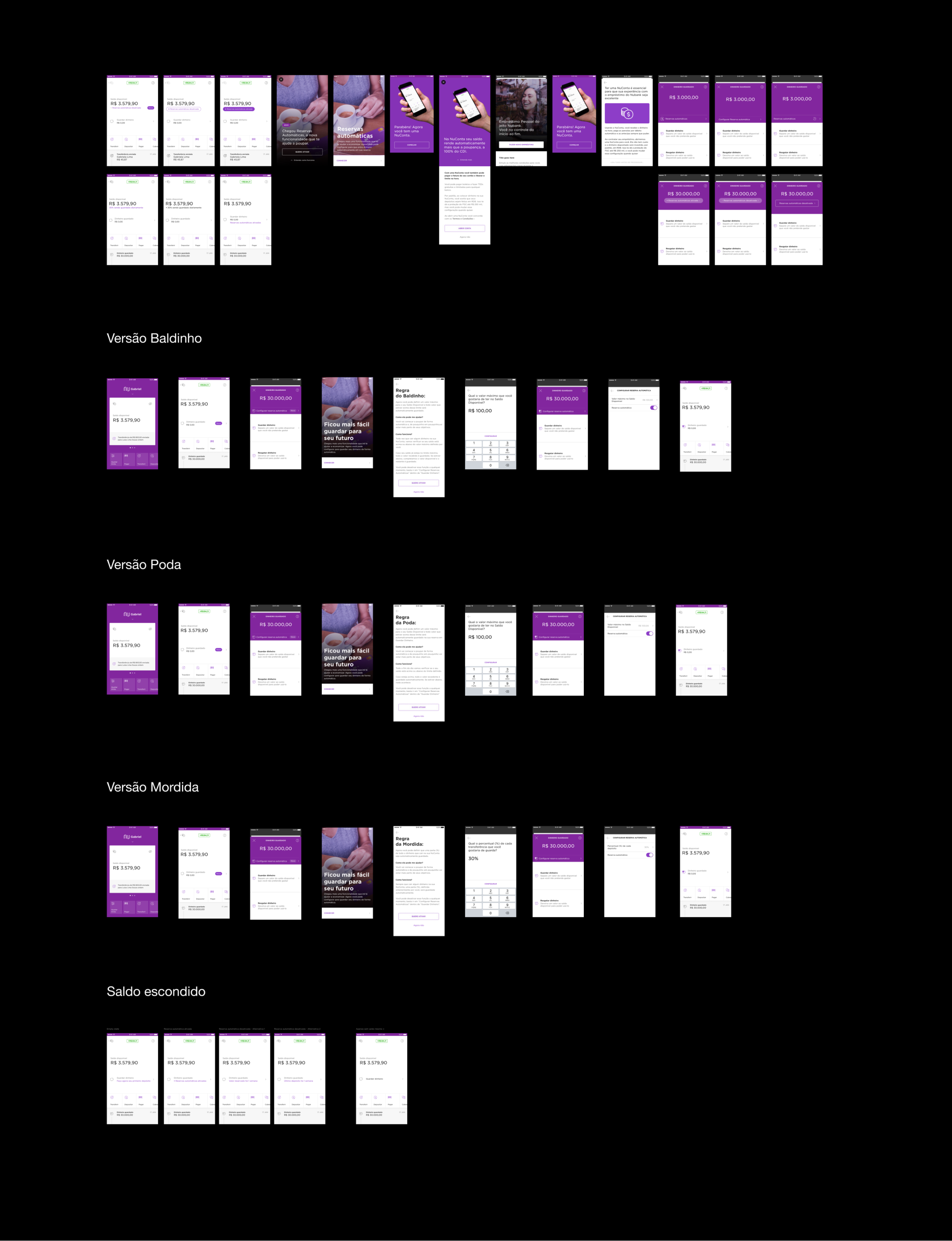

Next, we conducted another workshop using the Crazy 8 method to brainstorm rules that could help users automate their savings. This process led us to identify three rules for qualitative and quantitative testing:

We managed to come up with 3 rules that we would like to test with our users qualitatively and quantitatively:

"Baldinho": Set a limit for your account. After each transaction, if the balance is above the limit, the excess is saved. If it's below, we fill the gap and then save.

"Poda": Set a limit for your account. At the end of each day, if the balance is above the limit, the excess is saved. If it's below, we fill the gap and then save.

"Mordida": Define a percentage, and with each transaction, a portion of the value is saved automatically.

We also designed an initial interface prototype for these rules, which was tested with customers to gather feedback and refine the experience.

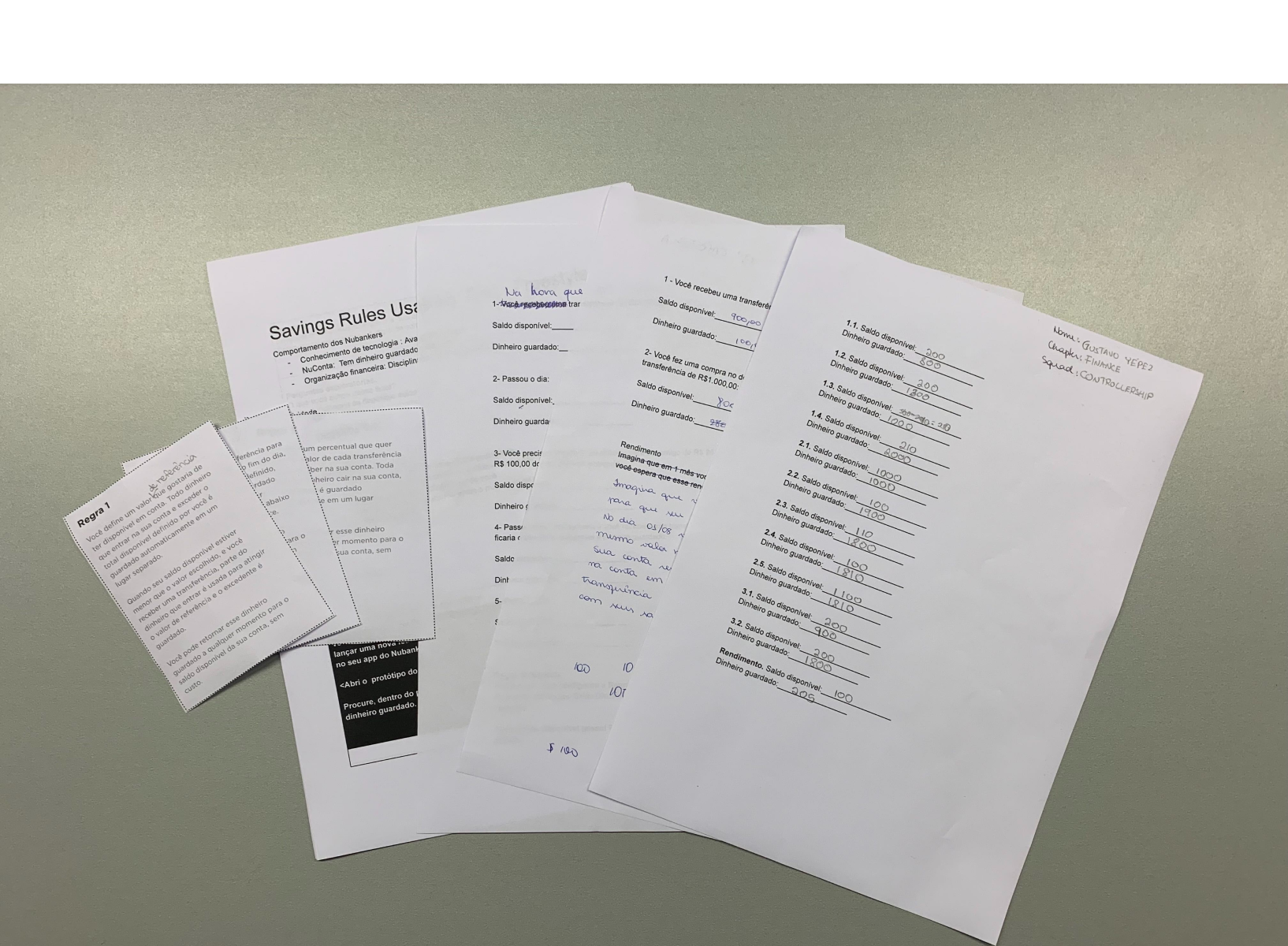

5. Researches

We began with qualitative research, conducting usability tests to determine if users understood the logic behind our savings rules and the initial interface designs.

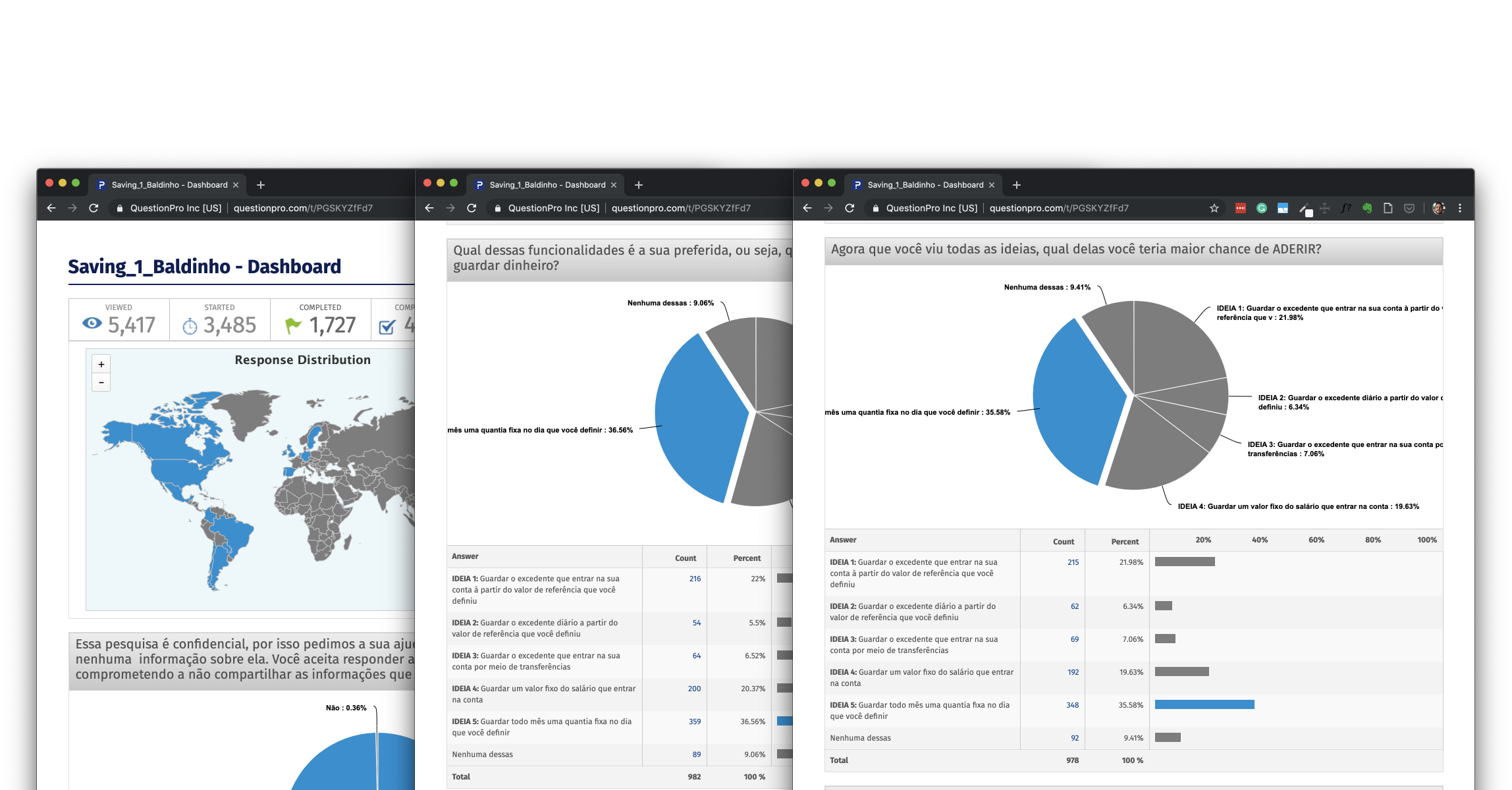

Building on this, we compiled the results and conducted quantitative analysis, expanding our exploration by introducing two additional rules:

"Fixo": Set a fixed amount and date to save every month.

"Salário": Allocate a percentage of your salary to be saved automatically.

5. MVP, Results and Next Steps

We developed an MVP of the feature and launched it to customers, monitoring the results to identify opportunities for improvement and define next steps.

The overall results were positive, leading us to maintain the feature and roll it out to all customers. However, we identified room for improvement, particularly in expanding the available savings rules to provide users with more flexibility and options.